Ftechnics API solutions are designed to serve market professionals to further program and integrate their codes and systems to receive real-time streaming executable quotes via a data feed, submit orders in various order types, and execute / delete or modify orders.

Ftechnics currently offers FIX protocol based API solutions for API Trading. Our FIX API provides multi-liquidity provider pricing via a FIX 4.4 protocol.

For general information about FIX APIs, please refer to: www.fixprotocol.org.

API system is a one stop connection of experts to select liquidity solutions. Client will have all basic functionality to trade FX and spot metals as if he is trading via a standard Prodigy GUI system.

API system is a one stop connection of experts to select liquidity solutions. Client will have all basic functionality to trade FX , spot metals and CFDs as if he is trading via a standard Prodigy GUI system.

What is FIX? The Financial Information exchange (FIX) Protocol is a technical specification for electronic communication of financial data that is a globally accepted standard of messaging specifications. For more information and supporting materials on the FIX protocol, please refer to the FPL website, http://www.fixprotocol.org.

Receive streaming tradeable quotes

Send orders

Get executions reports

Cancel and replace working orders

Request for open and closed positions

Request for account values

Market Order: An order to buy or sell immediately at the best available price Limit Order: An order to buy or sell at a specified target price or better Stop Order: An order to buy or sell when the market surpasses a specified price. This order is usually used to stop losses but can also be used as an entry order One Cancels the Other (OCO) Order: One limit and one stop order where the fill of one leg cancels the other leg

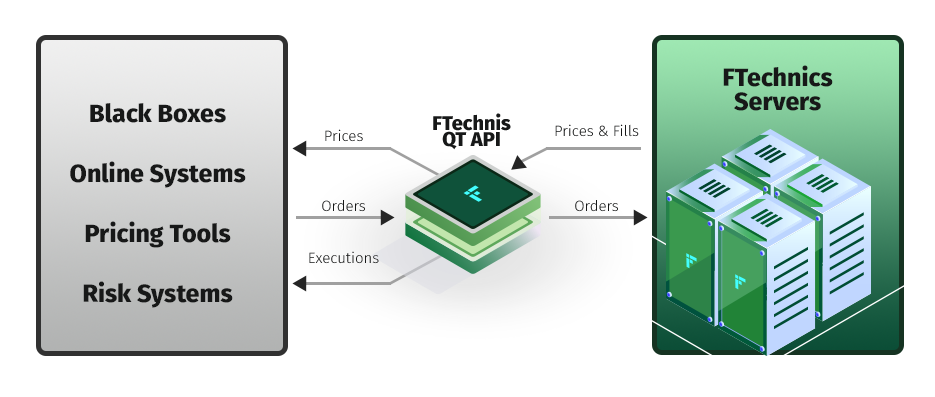

The socket based API is a messaging policy system for developing server side communication applications for automatic order execution and streaming price feed. The system does not force developers to use any kind of third party dll or compiled code. Any environment that allows socket connection and send XML messages over it, is able to interact with the eFips servers. So the architecture is independent from the type of the operating system, networking structure, programming language that the client applications are using.

Data transfer over the internet is encrypted via secure shell

Critical operations like sending or amending orders are protected with secure key exchange algorithm with client specific initial private keys

In this API, for every single message sent from the client to the server, there is a two phase response structure. The client is informed initially by the reach of the message to the server immediately. The result of the operation is sent with the second response message.

Meet the well known Meta Trader 4 with Ftechnics White Label Support. The MetaTrader 4 terminal is a perfectly equipped traders workplace that allows to trade in FX, Bullion and CFDs.

Ftechnics API solutions are designed to serve market professionals to further program and integrate their codes and systems to receive real-time streaming executable quotes via a data feed, submit orders in various order types, and execute / delete or modify orders.

Ftechnics currently offers FIX protocol based API solutions for API Trading. Our FIX API provides multi-liquidity provider pricing via a FIX 4.4 protocol.

For general information about FIX APIs, please refer to: www.fixprotocol.org.

API system is a one stop connection of experts to select liquidity solutions. Client will have all basic functionality to trade FX and spot metals as if he is trading via a standard Prodigy GUI system.

API system is a one stop connection of experts to select liquidity solutions. Client will have all basic functionality to trade FX , spot metals and CFDs as if he is trading via a standard Prodigy GUI system.

Ftechnics offers backoffice solutions for the FX and Derivatices market guided by market specialists to meet your needs. Now you can reduce the time and resources you spend on operational and administrative activities.

FTechnics offers you an extensive list of selections on risk management tools you would like to implement when trading on FX market. You can protect yourself from unfavorable outcomes or increase your profits by implementing strategies using these tools.

F-MATCH system allows market makers join the market depth with their quotes with its order input options from APIs and other online systems via its API interface. The API interface is independent of the programming language that the counterparty is willing to use. The system includes the whole order functionality package provided by the online system interface.